Step 1: What's Corporate Development All About?

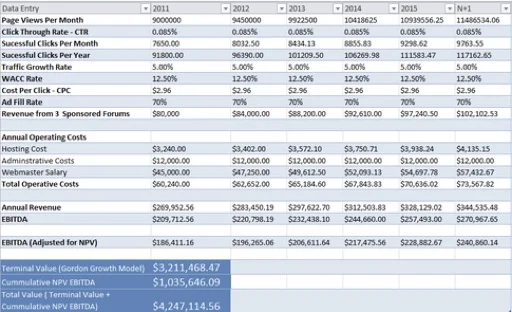

Valuation model

AKA: Corp Dev

Overview: CorpDev is all about M&A. In other words, the acquisition of smaller companies that you’re constantly reading about in the headlines: Facebook gobbles up Instagram, Google buys Nest, Apple acquires Beats.

Example project: Lead the acquisition of a startup with a high-traffic news site.

What you do all day: Analyze opportunities, build relationships, negotiate deals

Roles: Corporate Development Analyst/Associate (more junior), Corporate Development Manager (more senior)

What they look for: Former financial types with M&A experience (investment banks, private equity)

Example job: Corporate Development Associate, HP Enterprise

Step 2: Would You Be a Good Fit for Corporate Development?

Ask yourself if you'd love doing these kinds of things all day:

Evaluating the competitive landscape

Conducting due diligence on outside firms

Building financial models

Presenting M+A recommendations

Leading negotiations

If your answer is "Yes" to the majority of activities, you'd likely be a good fit for CorpDev.

Step 3: What Skills Do You Need for Corporate Development?

For each major activity, I've listed the most common keywords from across dozens of job descriptions, as well as a sample resume bullet:

· Evaluating the competitive landscape

o Keywords: source investment and acquisition opportunities, identify companies to acquire, industry trends, competitive landscape, strategic gaps, corporate weaknesses

o Sample Bullet: Developed competitive analysis of gaming portfolio, identifying weakness in the casual gaming segment that led to a $2B acquisition opportunity

· Conducting due diligence on outside firms

o Keywords: due diligence, company research, corporate financials, capital structures

o Sample Bullet: Managed due diligence on three potential acquisition targets, eliminating a disastrous option based on an unexpected capital structure

· Building financial models

o Keywords: financial analysis, models, Excel, valuation, deal modeling

o Sample Bullet: Created financial model for M&A opportunity, projecting a 27% ROI that was ultimately realized

· Presenting M+A recommendations

o Keywords: build/buy/partner recommendations, joint venture, business acquisition, storytelling, presentations, senior management

o Sample Bullet: Recommended joint venture to the executive team that, within two years, generated $18M in incremental revenue

· Leading negotiations

o Keywords: deal negotiation, deal structure, integrations, M&A negotiation, execution

o Sample Bullet: Oversaw negotiation with acquisition target, ensuring 100% employee retention in the first two critical years of the deal

Step 4: What Corporate Development Training Do You Recommend?

If you want to brush up on any of these skills, check out John Colley's Mergers and Acquisitions course on Udemy. I like two things about this course in particular:

It goes deep on valuation since that’s where most acquisitions go wrong. (e.g., Yahoo paying $4 billion for Geocities…)

And then it walks through the entire process, step-by-step, from pre-sale prep all the way to negotiation.

Step 5: How Do You Actually Get a Corporate Development Job?

To help you convert your passion and skills into an actual job, I've put together a step-by-step course that covers how to:

Design a resume that will mark you as an insider to tech recruiters

Make sure you find every single great tech job across multiple sites

Get a referral at just about any tech company - even if you don't know anyone directly

Prepare for every kind of tech interview question with point-by-point formulas